ontario ca sales tax calculator

The Ontario sales tax rate is. 13 for Ontario 15 for others.

Our free online California sales tax calculator calculates exact sales tax by state county city or ZIP code.

. Formula for calculating HST in Ontario. An 8 provincial. 91758 91761 and 91764.

Visit wwwcragcca or call 1-800-959-8287. This online book has multiple pages. Sales tax in Ontario.

Related

- penny round floor bathroom

- speedway car wash grapevine

- baldwin park animal shelter appointment

- texas car seat laws front facing

- sesame chicken near me delivery

- dodge ram 2500 diesel for sale on craigslist houston

- motel in crescent city ca

- private lessons movie poster

- warhill sports complex williamsburg va

- Atalanta–napoli

The HST is made up of two components. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975.

Sales taxes in Ontario where changed in 2010 then instead of GST and PST was introduced Harmonized sales tax HST. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021. It ranges from 13 in Ontario to 15 in other provinces and is composed of a provincial tax and a. Amount without sales tax x HST rate100 Amount of HST in Ontario.

Try our FREE income tax calculator. Useful for figuring out sales taxes if you sell products with tax included or if you want to extract tax amounts from grand totals. Sales Taxes in Ontario.

3070 E Sussex Privado Ontario CA 91762 778880 MLS WS22083207 Stunning newly built two story home with brand new wood flooring and customized sh. 3 beds 2 baths 1245 sq. 2021 free Ontario income tax calculator to quickly estimate your provincial taxes.

Although the HST replaced the 5 federal goods and services tax GST and the 8 retail sales tax RST on July 1 2010 RST still applies to certain premiums of insurance. Start filing your tax return now. 14 rows The following table provides the GST and HST provincial rates since.

Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. The minimum combined 2022 sales tax rate for Ontario California is. 5 beds 3 baths 2486 sq.

California has a 6 statewide sales tax rate but also has 474 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2617 on top. The current total local sales tax rate in Ontario CA is 7750. The California sales tax rate is currently.

Ministry of Finance Land Taxes Section 33 King Street West Oshawa ON L1H 8H9. Your average tax rate is 270 and your marginal tax rate is 353. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax.

This marginal tax rate means that your immediate additional income will be taxed at this rate. History of sales taxes in Ontario. California Department of Tax and Fee Administration Cities Counties and Tax Rates.

The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST. On July 1st 2010 HST Harmonized Sales. TAX DAY NOW MAY 17th - There are -355 days left until taxes are due.

Amount without sales tax HST amount Total amount with sales taxes. The Harmonized Sales Tax HST is 13 in Ontario. There are approximately 82703 people living in the Ontario area.

Most transactions of goods or services between businesses are not subject to sales tax. The minimum combined 2022 sales tax rate for Ontario California is. This is the total of state county and city sales.

Harmonized Sales Tax HST in Ontario What is the current 2022 HST rate in Ontario. 2419 S Taylor Pl Ontario CA 91761 653000 MLS IV22016517 This charming 3 bedroom 2 bathroom 2 car garage home is now on the market. Learn about retail sales tax on private purchases of specified vehicles and on certain premiums of insurance and benefits plans.

The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax. An alternative sales tax rate of 9 applies in the tax region Montclair which appertains to zip code 91762. 5 Federal part and 8 Provincial Part.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. To calculate the total amount and sales taxes from a. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Ontario CA.

Here is an example of how Ontario applies sales tax. Sales Tax Calculator Sales Tax Table. 100 13 HST 113 total.

3481 E Sweetbay Way Ontario CA 91761 783990 MLS IV22082711 Corner Lot. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. This is the total of state county and city sales tax rates.

The December 2020 total local sales tax rate was also 7750. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. The County sales tax rate is.

The HST was adopted in Ontario on July 1st 2010. Wayfair Inc affect California. Did South Dakota v.

Refunds of Land Transfer Tax including Non-Resident Speculation Tax and Rebates of Non-Resident Speculation Tax. 3 beds 2 baths 1583 sq. Ontario taxes and COVID-19.

Ontariotaxcalculator is a simple efficient and easy to use tool in ontario to calculate sales tax hst. Ontario provides relief on the 8 provincial portion of the HST on specific items through a point of sale rebate. Current 2022 HST rate in Ontario province is 13.

This 3-bedroom private single family residence features an open conc. Retail sales tax RST is charged on. The Ontario California sales tax rate of 775 applies to the following three zip codes.

That means that your net pay will be 37957 per year or 3163 per month.

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

How To Calculate Sales Tax In Excel Tutorial Youtube

91762 Sales Tax Rate Ca Sales Taxes By Zip

How To Calculate Sales Tax In Excel

2021 2022 Income Tax Calculator Canada Wowa Ca

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Canada Sales Tax Gst Hst Calculator Wowa Ca

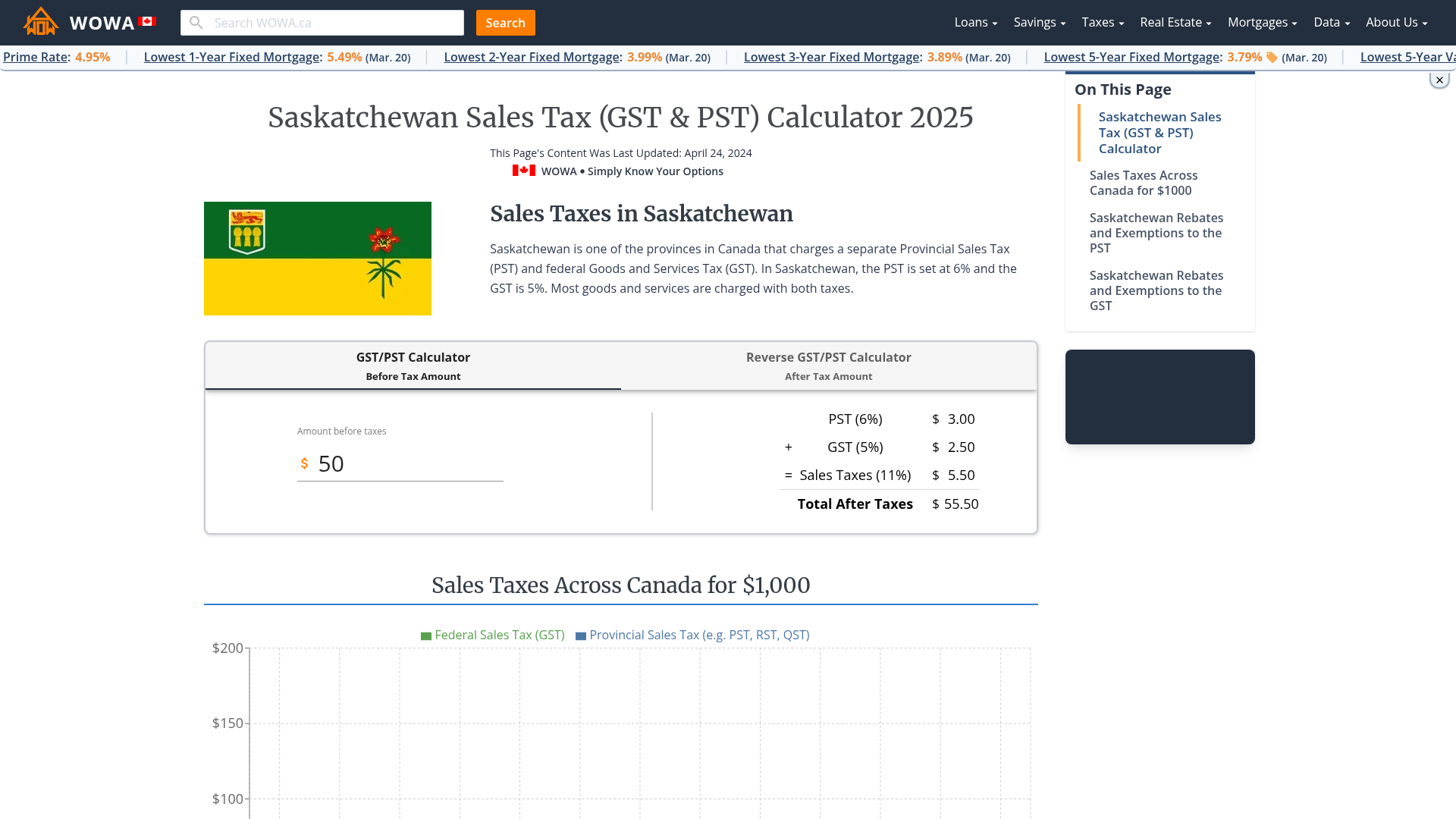

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

How To Calculate Sales Tax In Excel

Sales Tax Canada Calculator On The App Store

Taxtips Ca 2019 Sales Tax Rates For Pst Gst And Hst In Each Province

Simple Tax Calculator For 2021 Cloudtax

Income Tax Calculator Calculatorscanada Ca

Ontario Income Tax Calculator Calculatorscanada Ca

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

Canadian Gst Hst Pst Tps Tvq Qst Sales Tax Calculator